With Rents on the Rise – Is Now the Time To Buy?

According to recent data from realtor.com, median rental prices have reached their highest point ever recorded in many areas across the country. The report found rents rose by 8.1% from the same time last year. As it notes:

“Beyond simply recovering to pre-pandemic levels, rents across the country are surging. Typically, rents fluctuate less than 1% from month to month. In May and June, rents increased by 3.0% and 3.2% from each month to the next.”

If you’re a renter concerned about rising prices, now may be the time to consider purchasing a home.

Monthly Rents Are Higher Than Monthly Mortgage Payments

When you weigh your options of whether to buy a home or continue renting, how much you’ll pay each month is likely top of mind. According to the National Association of Realtors (NAR), monthly mortgage payments are rising, but they’re still significantly lower than the typical rental payment. NAR indicates the latest data on homes closed shows the median monthly mortgage payment is $1,204.

According to recent data from realtor.com, median rental prices have reached their highest point ever recorded in many areas across the country. The report found rents rose by 8.1% from the same time last year. As it notes:

“Beyond simply recovering to pre-pandemic levels, rents across the country are surging. Typically, rents fluctuate less than 1% from month to month. In May and June, rents increased by 3.0% and 3.2% from each month to the next.”

If you’re a renter concerned about rising prices, now may be the time to consider purchasing a home.

Monthly Rents Are Higher Than Monthly Mortgage Payments

When you weigh your options of whether to buy a home or continue renting, how much you’ll pay each month is likely top of mind. According to the National Association of Realtors (NAR), monthly mortgage payments are rising, but they’re still significantly lower than the typical rental payment. NAR indicates the latest data on homes closed shows the median monthly mortgage payment is $1,204.

By contrast, the median national rent is $1,575 according to the most current data provided by realtor.com. In other words, buyers who recently purchased a home locked in a monthly payment that is, on average, $371 lower than what renters pay today (see graph below):

Rents Are Rising Sharply, and They Continue To Increase

The difference in monthly housing costs when comparing renting and homebuying today is significant, but many would-be homebuyers wonder about the future of rental prices. If we look to historical Census data as a reference, the median asking rent has risen consistently since 1988 (see graph below):

The rise in rent over time clearly shows one of the major advantages homeownership has over renting: stable housing costs. Renters face increasing costs every year. When you purchase your home, your mortgage rate is locked in for 30 years, meaning your monthly payment stays the same over time. That gives you welcome peace of mind and predictability for many years ahead.

Bottom Line

With rents continuing to rise across the country, renters should consider if now is the right time to buy. There are multiple benefits to buying sooner rather than later. Let’s discuss your options so you can make your most powerful decision.

Key Questions To Ask Yourself Before Buying a Home

Key Questions To Ask Yourself Before Buying a Home

Sometimes it can feel like everyone has advice when it comes to buying a home. While your friends and loved ones may have your best interests in mind, they may also be missing crucial information about today’s housing market that you need to make your best decision.

Before you decide whether you’re ready to buy a home, you should know how to answer these three questions.

1. What’s Going on with Home Prices?

Home prices are one factor that directly impacts how much it will cost to buy a home and how much you stand to gain as a homeowner when prices appreciate.

Sometimes it can feel like everyone has advice when it comes to buying a home. While your friends and loved ones may have your best interests in mind, they may also be missing crucial information about today’s housing market that you need to make your best decision.

Before you decide whether you’re ready to buy a home, you should know how to answer these three questions.

1. What’s Going on with Home Prices?

Home prices are one factor that directly impacts how much it will cost to buy a home and how much you stand to gain as a homeowner when prices appreciate.

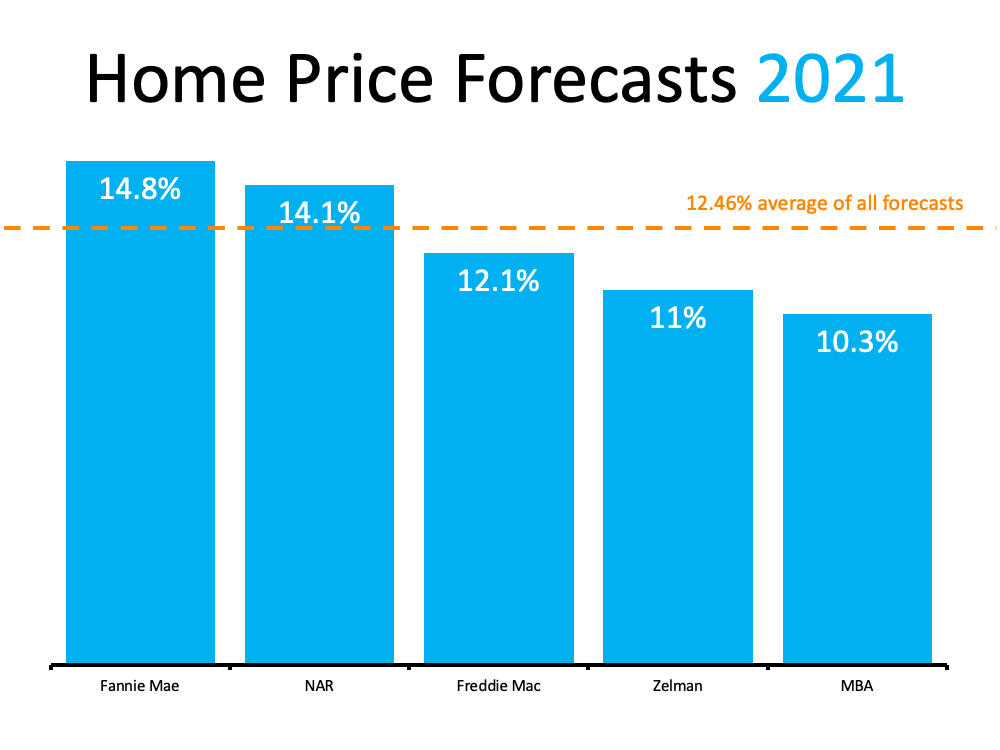

The graph below shows just how much experts are forecasting prices to rise this year:

Continued price appreciation is great news for existing homeowners but can pose a significant challenge if you wait to buy. Using these forecasts, you can determine just how much waiting could cost you. If prices increase based on the average of all forecasts (12.46%), a median-priced home that cost $350,000 in January of 2021 will cost an additional $43,610 by the end of the year. What does this mean for you? Put simply, with home prices increasing, the longer you wait, the more it could cost you.

2. Are Today’s Low Mortgage Rates Going To Last?

Another significant factor that should inform your decision is mortgage interest rates. Today’s average rates remain close to record-lows. Much like prices, though, experts forecast rates will rise over the coming months, as the chart below shows:

Your monthly mortgage payment can be significantly impacted by even the slightest increase in mortgage rates, which makes the overall cost of the home greater over time when you wait.

3. Why Is Homeownership Important to You?

The final question is a personal one. Before deciding, you’ll need to understand your motivation to buy a home and why homeownership is an important goal for you. The financial benefits of owning a home are often easier to account for than the many emotional ones.

The 2021 National Homeownership Market Survey shows that six of the nine reasons Americans value homeownership are because of how it impacts them on a personal, aspirational level. The survey says homeownership provides:

Stability

Safety

A Sense of Accomplishment

A Life Milestone

A Stake in the Community

Personal Pride

The National Housing & Financial Capability Survey from NeighborWorks America also highlights the emotional benefits of homeownership:

Clearly, there’s a value to homeownership beyond the many great financial opportunities it provides. It gives homeowners a sense of pride, safety, security, and accomplishment – which impacts their lives and how they feel daily.

Bottom Line

Homeownership is life-changing, and buying a home can positively impact you in so many ways. With any decision this big, it helps to have a trusted advisor by your side each step of the way. If you’re ready to begin your journey toward homeownership, let’s connect to discuss your options and begin your journey.

A Look at Housing Supply and What It Means for Sellers

One of the hottest topics of conversation in today’s real estate market is the shortage of available homes. Simply put, there are many more potential buyers than there are homes for sale. As a seller, you’ve likely heard that low supply is good news for you. It means your house will get more attention, and likely, more offers. But as life begins to return to normal, you may be wondering if that’s something that will change.

While it may be tempting to blame the pandemic for the current inventory shortage, the pandemic can’t take all the credit. While it did make some sellers hold off on listing their houses over the past year, the truth is the low supply of homes was years in the making. Let’s take a look at the root cause and what the future holds to uncover why now is still a great time to sell.

Where Did the Shortage Come From?

One of the hottest topics of conversation in today’s real estate market is the shortage of available homes. Simply put, there are many more potential buyers than there are homes for sale. As a seller, you’ve likely heard that low supply is good news for you. It means your house will get more attention, and likely, more offers. But as life begins to return to normal, you may be wondering if that’s something that will change.

While it may be tempting to blame the pandemic for the current inventory shortage, the pandemic can’t take all the credit. While it did make some sellers hold off on listing their houses over the past year, the truth is the low supply of homes was years in the making. Let’s take a look at the root cause and what the future holds to uncover why now is still a great time to sell.

Where Did the Shortage Come From?

It’s not just today’s high buyer demand. Our low supply goes hand-in-hand with the number of new homes built over the past decades. According to Sam Khater, VP and Chief Economist at Freddie Mac:

“The main driver of the housing shortfall has been the long-term decline in the construction of single-family homes.”

Data in a recent report from the National Association of Realtors (NAR) tells the same story. New home construction has been lagging behind the norm for quite some time. Historically, builders completed an average of 1.5 million new housing units per year. However, since the housing bubble in 2008, the level of new home construction has fallen off (see graph below):

The same NAR report elaborates on the impact of this below-average pace of construction:

“. . . the underbuilding gap in the U.S. totaled more than 5.5 million housing units in the last 20 years.”

“Looking ahead, in order to fill an underbuilding gap of approximately 5.5 million housing units during the next 10 years, while accounting for historical growth, new construction would need to accelerate to a pace that is well above the current trend, to more than 2 million housing units per year. . . .”

That means if we build even more new houses than the norm every year, it’ll still take a decade to close the underbuilding gap contributing to today’s supply-and-demand mix. Does that mean today’s ultimate sellers’ market is here to stay?

We’re already starting to see an increase in new home construction, which is great news. But newly built homes can’t bridge the supply gap we’re facing right now on their own. In the State of the Nation’s Housing 2021 Report, the Joint Center for Housing Studies of Harvard University (JCHS) says:

“…Although part of the answer to the nation’s housing shortage, new construction can only do so much to ease short-term supply constraints. To meet today’s strong demand, more existing single-family homes must come on the market.”

Early Indicators Show More Existing-Home Inventory Is on Its Way

When we look at existing homes, the latest reports signal that housing supply is growing gradually month-over-month. This uptick in existing homes for sale shows things are beginning to shift. Based on recent data, Odeta Kushi, Deputy Chief Economist at First American, has this to say:

“It looks like existing inventory is starting to inch up, which is good news for a housing market parched for more supply.”

Lawrence Yun, Chief Economist at NAR, echoes that sentiment:

“As the inventory is beginning to pick up ever so modestly, we are still facing a housing shortage, but we may have turned a corner.”

So, what does all of this mean for you? Just because life is starting to return to normal, it doesn’t mean you missed out on the best time to sell. It’s not too late to take advantage of today’s sellers’ market and use rising equity and low interest rates to make your next move.

Bottom Line

It’s still a great time to sell. Even though housing supply is starting to trend up, it’s still hovering near historic lows. Let’s connect to discuss how you can list your house now and use the inventory shortage to get the best possible terms for you.

3 Charts That Show This Isn’t a Housing Bubble

With home prices continuing to deliver double-digit increases, some are concerned we’re in a housing bubble like the one in 2006. However, a closer look at the market data indicates this is nothing like 2006 for three major reasons.

1. The housing market isn’t driven by risky mortgage loans.

Back in 2006, nearly everyone could qualify for a loan. The Mortgage Credit Availability Index (MCAI) from the Mortgage Bankers’ Association is an indicator of the availability of mortgage money. The higher the index, the easier it is to obtain a mortgage. The MCAI more than doubled from 2004 (378) to 2006 (869). Today, the index stands at 130. As an example of the difference between today and 2006, let’s look at the volume of mortgages that originated when a buyer had less than a 620 credit score.

With home prices continuing to deliver double-digit increases, some are concerned we’re in a housing bubble like the one in 2006. However, a closer look at the market data indicates this is nothing like 2006 for three major reasons.

1. The housing market isn’t driven by risky mortgage loans.

Back in 2006, nearly everyone could qualify for a loan. The Mortgage Credit Availability Index (MCAI) from the Mortgage Bankers’ Association is an indicator of the availability of mortgage money. The higher the index, the easier it is to obtain a mortgage. The MCAI more than doubled from 2004 (378) to 2006 (869). Today, the index stands at 130. As an example of the difference between today and 2006, let’s look at the volume of mortgages that originated when a buyer had less than a 620 credit score.

Dr. Frank Nothaft, Chief Economist for CoreLogic, reiterates this point:

“There are marked differences in today’s run up in prices compared to 2005, which was a bubble fueled by risky loans and lenient underwriting. Today, loans with high-risk features are absent and mortgage underwriting is prudent.”

2. Homeowners aren’t using their homes as ATMs this time.

During the housing bubble, as prices skyrocketed, people were refinancing their homes and pulling out large sums of cash. As prices began to fall, that caused many to spiral into a negative equity situation (where their mortgage was higher than the value of the house).

Today, homeowners are letting their equity build. Tappable equity is the amount available for homeowners to access before hitting a maximum 80% combined loan-to-value ratio (thus still leaving them with at least 20% equity). In 2006, that number was $4.6 billion. Today, that number stands at over $8 billion.

Yet, the percentage of cash-out refinances (where the homeowner takes out at least 5% more than their original mortgage amount) is half of what it was in 2006.

3. This time, it’s simply a matter of supply and demand.

FOMO (the Fear Of Missing Out) dominated the housing market leading up to the 2006 housing bubble and drove up buyer demand. Back then, housing supply more than kept up as many homeowners put their houses on the market, as evidenced by the over seven months’ supply of existing housing inventory available for sale in 2006. Today, that number is barely two months.

Builders also overbuilt during the bubble but pulled back significantly over the next decade. Sam Khater, VP and Chief Economist, Economic & Housing Research at Freddie Mac, explains that pullback is the major factor in the lack of available inventory today:

“The main driver of the housing shortfall has been the long-term decline in the construction of single-family homes.”

Here’s a chart that quantifies Khater’s remarks:

Today, there are simply not enough homes to keep up with current demand.

Bottom Line

This market is nothing like the run-up to 2006. Bill McBride, the author of the prestigious Calculated Risk blog, predicted the last housing bubble and crash. This is what he has to say about today’s housing market:

“It’s not clear at all to me that things are going to slow down significantly in the near future. In 2005, I had a strong sense that the hot market would turn and that, when it turned, things would get very ugly. Today, I don’t have that sense at all, because all of the fundamentals are there. Demand will be high for a while because Millennials need houses. Prices will keep rising for a while because inventory is so low.”

Selling Your House? Make Sure You Price It Right.

There’s no denying we’re in a sellers’ market. With low inventory and high buyer demand, homes today are selling above the asking price at a record rate. According to the latest Realtors Confidence Index Survey from the National Association of Realtors (NAR):

Homes typically sell within 17 days (compared to 26 days one year ago).

The average home sold has five offers to pick from.

54% of offers are over the asking price.

Because so many buyers are competing for so few homes, bidding wars are driving up home prices. According to an average of leading expert projections, existing home prices are expected to increase by 8.9% this year.

Yet even in today’s red-hot sellers’ market, it’s important to price your house right. While it may be tempting to price your house on the high side to capitalize on this trend, doing so could limit your house’s potential.

Why Pricing Your House Right Matters

Here’s the thing – a high price tag doesn’t mean you’re going to cash in big on the sale. While you may be trying to maximize your return, the tradeoff may be steep. A high list price is more likely to deter buyers, sit on the market longer, or require a price drop that can raise questions among prospective buyers.

Instead, focus on setting a price that’s fair. Real estate professionals know the value of your home. By pricing your house based on its current condition and similar homes that have recently sold in your area, your agent can help you set a price that’s realistic and obtainable – and that’s good news for you and for buyers.

When you price your house right, you increase your home’s visibility, which drives more buyers to your front door. The more buyers that tour your home, the more likely you’ll have a multi-offer scenario to create a bidding war. When multiple buyers compete for your house, that sets you up for a bigger win.

Bottom Line

When it comes to pricing your house, working with a local real estate professional is essential. Let’s connect so we can optimize your exposure, your timeline, and the return on your investment, too.

There’s no denying we’re in a sellers’ market. With low inventory and high buyer demand, homes today are selling above the asking price at a record rate. According to the latest Realtors Confidence Index Survey from the National Association of Realtors (NAR):

Homes typically sell within 17 days (compared to 26 days one year ago).

The average home sold has five offers to pick from.

54% of offers are over the asking price.

Because so many buyers are competing for so few homes, bidding wars are driving up home prices. According to an average of leading expert projections, existing home prices are expected to increase by 8.9% this year.

Yet even in today’s red-hot sellers’ market, it’s important to price your house right. While it may be tempting to price your house on the high side to capitalize on this trend, doing so could limit your house’s potential.

Why Pricing Your House Right Matters

Here’s the thing – a high price tag doesn’t mean you’re going to cash in big on the sale. While you may be trying to maximize your return, the tradeoff may be steep. A high list price is more likely to deter buyers, sit on the market longer, or require a price drop that can raise questions among prospective buyers.

Instead, focus on setting a price that’s fair. Real estate professionals know the value of your home. By pricing your house based on its current condition and similar homes that have recently sold in your area, your agent can help you set a price that’s realistic and obtainable – and that’s good news

When you price your house right, you increase your home’s visibility, which drives more buyers to your front door. The more buyers that tour your home, the more likely you’ll have a multi-offer scenario to create a bidding war. When multiple buyers compete for your house, that sets you up for a bigger win.

Bottom Line

When it comes to pricing your house, working with a local real estate professional is essential. Let’s connect so we can optimize your exposure, your timeline, and the return on your investment, too.

The Truths Young Homebuyers Need To Hear

For many young or first-time homebuyers, purchasing a home can feel intimidating. A recent survey shows some homebuyers ages 25 to 40 may be unsure about the homebuying process and what they can afford. It found:

“1 in 4 underestimated their buying potential by $150k or more”

“1 in 4 underestimated the increase in value by $100k or more”

“47% don’t know what a good interest rate is”

Because they feel uncertain, many young homebuyers have given up on their search, or worse, they’ve decided homebuying isn’t for them and never started on their journey to begin with.

If you’re interested in buying but aren’t sure where to begin, here are three key concepts about homeownership you should understand before you get started.

For many young or first-time homebuyers, purchasing a home can feel intimidating. A recent survey shows some homebuyers ages 25 to 40 may be unsure about the homebuying process and what they can afford. It found:

“1 in 4 underestimated their buying potential by $150k or more”

“1 in 4 underestimated the increase in value by $100k or more”

“47% don’t know what a good interest rate is”

Because they feel uncertain, many young homebuyers have given up on their search, or worse, they’ve decided homebuying isn’t for them and never started on their journey to begin with.

If you’re interested in buying but aren’t sure where to begin, here are three key concepts about homeownership you should understand before you get started.

1. What You Need To Know About Down Payments

Saving for a down payment is sometimes viewed as one of the biggest obstacles for homebuyers, but that doesn’t have to be the case. As Freddie Mac says:

“The most damaging down payment myth—since it stops the homebuying process before it can start—is the belief that 20% is necessary.”

According to the most recent Home Buyers and Sellers Generational Trends Report from the National Association of Realtors (NAR), the median down payment for homes purchased between July 2019 and June 2020 was only 12%. That number is even lower when we control for age – for buyers in the 22 to 30 age range, the median down payment was only 6%.

2. You May Be Able To Afford More Home Than You Think

Working remotely, exercising, and generally spending more time than ever in our homes has changed what many people are looking for in their living space. However, some young homebuyers don’t feel they can afford a home that suits their growing needs and have decided to continue renting instead. That means they’ll miss out on some of the long-term benefits of owning a home. As an article recently published by NAR points out:

“Many young adults are underestimating how much they need for homeownership, the survey finds. Millennials underestimated how much home they can afford right now, how much interest they would pay over a 30-year mortgage, and how much home values appreciate, on average, over 10 years…”

Knowing how much home you can afford when starting the buying process is critical and could be the game-changer that gets you from renting to buying.

3. Homeownership Will Become Less Affordable the Longer You Wait

Finally, with mortgage rates starting to rise along with home prices appreciating, putting off buying a home now could cost you much more later. Sam Khater, Chief Economist at Freddie Mac, notes:

“As the economy progresses and inflation remains elevated, we expect that rates will continually rise in the second half of the year.”

Most experts forecast interest rates will rise in the months ahead, and even the smallest increase can influence your buying power. If you’ve been on the fence about buying a home, there’s no time like the present.

Bottom Line

If you feel overwhelmed by the prospect of starting your home search, you’re not alone. Let’s connect today so we can talk more about the process, what you’ll need to start your search, and what to expect.

A Look at Home Price Appreciation Through 2025

Home prices have increased significantly over the last year, which in turn has grown the net worth of homeowners. Appreciation and home equity are directly linked – as the value of a home increases, so does a homeowner’s equity. And with these recent gains, homeowners are witnessing their financial stability and well-being grow to record levels.

In more good news for homeowners, the most recent Home Price Expectations Survey – a survey of a national panel of over one hundred economists, real estate experts, and investment and market strategists – forecasts home prices will continue appreciating over the next five years, adding to the record amount of equity homeowners have already gained over the past year.

Home prices have increased significantly over the last year, which in turn has grown the net worth of homeowners. Appreciation and home equity are directly linked – as the value of a home increases, so does a homeowner’s equity. And with these recent gains, homeowners are witnessing their financial stability and well-being grow to record levels.

In more good news for homeowners, the most recent Home Price Expectations Survey – a survey of a national panel of over one hundred economists, real estate experts, and investment and market strategists – forecasts home prices will continue appreciating over the next five years, adding to the record amount of equity homeowners have already gained over the past year. Below are the expected year-over-year rates of home price appreciation from the report:

What Does This Mean for Homeowners?

Home prices are climbing today, and the data in the survey indicates they’ll continue to increase, but at rates that approach a more normal pace. Even still, the amount of household wealth a homeowner stands to earn going forward is substantial. This truly becomes clear when we consider a scenario using a median-priced home purchased in January of 2021 and the projected rate of appreciation on that home over the next five years. As the graph below illustrates, a homeowner could increase their net worth by a significant amount – over $93,000 dollars by 2026.

Home Price Appreciation and Home Equity

CoreLogic recently released their quarterly Homeowner Equity Insights Report, which tracks the year-over-year increases in equity. It shows an average annual gain of $33,400 per borrower over the past 12 months. In the report, Dr. Frank Nothaft, Chief Economist for CoreLogic, further explains:

“Double-digit home price growth in the past year has bolstered home equity to a record amount. The national CoreLogic Home Price Index recorded an 11.4% rise in the year through March 2021, leading to a $216,000 increase in the average amount of equity held by homeowners with a mortgage.”

The expected, sustained growth of home prices means homeowners can continue to build on the past year’s record levels of home equity – and their financial prosperity. It also presents today’s homeowners with a unique opportunity: using their growing equity for a home upgrade. With so few homes available to purchase and strong buyer demand, there may not be a better time to sell your current house and move into one that better meets your needs.

Bottom Line

Home prices are expected to continue appreciating over the next five years, and the associated equity gains are the quickest way homeowners can build household wealth. If you’re a current homeowner who’s ready to take advantage of your built-up equity, let’s connect today to discuss your options.

Content from: www.simplifyingthemarket.com

Save Time and Effort by Selling with an Agent

Selling a house is a time-consuming process – especially if you decide to do it on your own, known as a For Sale By Owner (FSBO). From conducting market research to reviewing legal documents, handling negotiations, and more, it’s an involved and highly detailed process that requires a lot of expertise to navigate effectively.

To help you understand just how much time and effort it takes to sell on your own, here’s a look at a few of the things you need to think about before putting that “For Sale” sign up in your yard.

Selling a house is a time-consuming process – especially if you decide to do it on your own, known as a For Sale By Owner (FSBO). From conducting market research to reviewing legal documents, handling negotiations, and more, it’s an involved and highly detailed process that requires a lot of expertise to navigate effectively. That’s one of the reasons why the percentage of people selling their own house has declined from 19% to 8% (See graph below):

To help you understand just how much time and effort it takes to sell on your own, here’s a look at a few of the things you need to think about before putting that “For Sale” sign up in your yard.

1. Making a Good First Impression

While it may sound simple, there are a lot of proven best practices to consider when prepping a house for sale.

Do you need to take down your personal art?

What’s the right amount of landscaping to boost your curb appeal?

What wall colors are most appealing to buyers?

If you do this work on your own, you may invest capital and many hours into the wrong things. Your time is money – don’t waste it. An agent can help steer you in the right direction based on current market conditions to save you time and effort. Since we’re in a hot sellers’ market, you don’t want to delay listing your house by focusing on things that won’t change your bottom line. These market conditions may not last, so lean on an agent to capitalize on today’s low inventory while you can.

2. Pricing It Right

Real estate professionals have mission-critical information on what sells and how to maximize your profit. They’re experienced when it comes to looking at recent comparable homes that have sold in your area and understanding what price is right for your neighborhood. They use that data to price your house appropriately, maximizing your return.

In a FSBO, you’re operating without this expertise, so you’ll have to do your own homework on how to set a price that’s appropriate for your area and the condition of your home. Even with your own research, you may not find the most up-to-date information and could risk setting a price that’s inaccurate or unrealistic. If you price your house too high, you could turn buyers away before they’re even in the front door, or run into problems when it comes time for the appraisal.

3. Maximizing Your Buyer Pool (and Profit)

Contrary to popular belief, FSBOs may actually net less profit than sellers who use an agent. One of the factors that can drive profit up is effective exposure. Simply put, real estate professionals can get your house in front of more buyers via their social media followers, agency resources, and proven sales strategies. The more buyers that view a home, the more likely a bidding war becomes. According to the National Association of Realtors (NAR), the average house for sale today gets 5 offers. Using an agent to boost your exposure may help boost your sale price too.

4. Navigating Negotiations

When it comes to selling your house as a FSBO, you’ll have to handle all of the negotiations. Here are just a few of the people you’ll work with:

The buyer, who wants the best deal possible

The buyer’s agent, who will use their expertise to advocate for the buyer

The inspection company, which works for the buyer and will almost always find concerns with the house

The appraiser, who assesses the property’s value to protect the lender

As part of their training, agents are taught how to negotiate every aspect of the real estate transaction and how to mediate potential snags that may pop up. When appraisals come in low and in countless other situations, they know what levers to pull, how to address the buyer and seller emotions that come with it, and when to ask for second opinions. Navigating all of this on your own takes time –a lot of it.

5. Juggling Legal Documentation

Speaking of time, consider how much free time you have to review the fine print. Just in terms of documentation, more disclosures and regulations are now mandatory. That means the stack of legal documents you need to handle as the seller is growing. It can be hard to know and truly understand all the terms and requirements. Instead of going at it alone, use an agent as your shield and advisor to help you avoid potential legal missteps.

Bottom Line

Selling your house on your own is a lot of responsibility. It’s time consuming and requires an immense amount of effort and expertise. Before you decide to sell your house yourself, let’s discuss your options so we can make sure you get the most out of the sale.

Source: https://bit.ly/3Ausms5

Pre-Approval Makes All the Difference When Buying a Home

You may have been told that it’s important to get pre-approved at the beginning of the homebuying process, but what does that really mean, and why is it so important? Especially in today’s market, with rising home prices and high buyer competition, it’s crucial to have a clear understanding of your budget so you stand out to sellers as a serious homebuyer.

Being intentional and competitive are musts when buying a home right now. Pre-approval from a lender is the only way to know your true price range and how much money you can borrow for your loan. Just as important, being able to present a pre-approval letter shows sellers you’re a qualified buyer, something that can really help you land your dream home in an ultra-competitive market.

With limited housing inventory, there are many more buyers active in the market than there are sellers, and that’s creating some serious competition. According to the National Association of Realtors (NAR), homes are receiving an average of 5.1 offers for sellers to consider. As a result, bidding wars are more and more common. Pre-approval gives you an advantage if you get into a multiple-offer scenario, and these days, it’s likely you will. When a seller knows you’re qualified to buy the home, you’re in a better position to potentially win the bidding war.

You may have been told that it’s important to get pre-approved at the beginning of the homebuying process, but what does that really mean, and why is it so important? Especially in today’s market, with rising home prices and high buyer competition, it’s crucial to have a clear understanding of your budget so you stand out to sellers as a serious homebuyer.

Being intentional and competitive are musts when buying a home right now. Pre-approval from a lender is the only way to know your true price range and how much money you can borrow for your loan. Just as important, being able to present a pre-approval letter shows sellers you’re a qualified buyer, something that can really help you land your dream home in an ultra-competitive market.

With limited housing inventory, there are many more buyers active in the market than there are sellers, and that’s creating some serious competition. According to the National Association of Realtors (NAR), homes are receiving an average of 5.1 offers for sellers to consider. As a result, bidding wars are more and more common. Pre-approval gives you an advantage if you get into a multiple-offer scenario, and these days, it’s likely you will. When a seller knows you’re qualified to buy the home, you’re in a better position to potentially win the bidding war.

Freddie Mac explains:

“By having a pre-approval letter from your lender, you’re telling the seller that you’re a serious buyer, and you’ve been pre-approved for a mortgage by your lender for a specific dollar amount. In a true bidding war, your offer will likely get dropped if you don’t already have one.”

Every step you can take to gain an advantage as a buyer is crucial when today’s market is constantly changing. Interest rates are low, prices are going up, and lending institutions are regularly updating their standards. You’re going to need guidance to navigate these waters, so it’s important to have a team of professionals such as a loan officer and a trusted real estate agent making sure you take the right steps and can show your qualifications as a buyer when you find a home to purchase.

Bottom Line

In a competitive market with low inventory, a pre-approval letter is a game-changing piece of the homebuying process. Not only does being pre-approved bring clarity to your homebuying budget, but it shows sellers how serious you are about purchasing a home.

Source: https://bit.ly/2X5eu9D

5 Things Homebuyers Need To Know When Making an Offer

When it comes to buying a house, you’re looking for the perfect place to call home. The problem is, in today’s market there just aren’t that many homes available to purchase. With inventory hovering near record lows and sky-high buyer demand, a multi-offer scenario is the new normal. Here are five things to keep in mind when you’re ready to make an offer.

When it comes to buying a house, you’re looking for the perfect place to call home. The problem is, in today’s market there just aren’t that many homes available to purchase. With inventory hovering near record lows and sky-high buyer demand, a multi-offer scenario is the new normal. Here are five things to keep in mind when you’re ready to make an offer.

1. Know Your Numbers

Having a complete understanding of your budget and how much house you can afford is essential. That’s why you should connect with a lender to get pre-approved for a loan early in the homebuying process. Taking this step shows sellers you’re a serious, qualified buyer and can give you a competitive edge in a bidding war.

2. Brace for a Fast Pace

Today’s market is dynamic and fast-paced. According to the Realtors Confidence Index from the National Association of Realtors (NAR), the average home is on the market for just 17 days – that means from start to finish, a house for sale in today’s climate is active for roughly 2.5 weeks. A skilled agent will do everything they can to help you stay on top of every possible opportunity. And, as soon as you find the right home for your needs, that agent will help you draft and submit your best offer as quickly as possible.

3. Lean on a Real Estate Professional

While homebuying may seem like a whirlwind process to you, local real estate agents do this every day, and we know what works. That expertise can be used to give you a significant leg up on your competition. An agent can help you consider what levers you can pull that might be enticing to a seller, like:

Offering flexible rent-back options to give the seller more time to move out

Your ability to do a quick close or make an offer that’s not contingent on the sale of your current home

It may seem simple, but catering to what a seller may need can help your offer stand out.

4. Make a Strong, but Fair Offer

Let’s face it – we all love a good deal. In the past, offering at or near the asking price was enough to make your offer appealing to sellers. In today’s market, that’s often not the case. According to Lawrence Yun, Chief Economist at NAR:

“For every listing there are 5.1 offers. Half of the homes are being sold above list price.”

In such a competitive market, emotions and prices can run high. Use an agent as your trusted advisor to make a strong, but fair offer based on market value, recent sales, and demand.

5. Be a Flexible Negotiator

If you followed tip #3, you drafted the offer with the seller’s needs in mind. That said, the seller may still counter with their own changes. Be prepared to amend your offer to include flexible move-in dates, a higher price, or minimal contingencies (conditions you set that the seller must meet for the purchase to be finalized). Just remember, there are certain contingencies you don’t want to forego. Freddie Mac explains:

“Resist the temptation to waive the inspection contingency, especially in a hot market or if the home is being sold ‘as-is’, which means the seller won’t pay for repairs. Without an inspection contingency, you could be stuck with a contract on a house you can’t afford to fix.”

Bottom Line

When it’s time to make an offer, it’s important to consider not just what you need, but what the seller may need too. Let’s connect so you have expert advice on this step in the homebuying process to put your best offer on the table.

Source: https://bit.ly/3xJ11jI

Housing Wealth: The Missing Piece of the Affordability Equation

The real estate market is soaring today. Residential home values are rising, and that’s a big win for homeowners. In 2020, there was a double-digit increase in home values – a trend that’s expected to head toward similar levels this year.

However, skyrocketing prices are causing some to start questioning affordability in the current housing market. Many are quick to emphasize the fact that homes today are less affordable than they were last year. Black Knight, a leading provider of data and analytics across the homeownership life cycle, just reported on the issue.

The findings show the historical averages of the national payment to income ratio, which they define as “the share of the median income needed to make the monthly payments on the median-priced home.” Their study reveals:

The average over the last 25 years was 23.6%

The average over the last 5 years was 20.1%

The average today stands at 20.5%

Right now, housing payments are slightly less affordable than the five-year average – but only by less than ½ a percentage point. However, they’re significantly more affordable than the 25-year average. Put another way, a buyer will likely make a slightly greater financial sacrifice to afford a home right now than if they purchased a home within the last five years. On the other hand, it also means the potential financial sacrifice is not nearly as great as it was over the last 25 years.

The real estate market is soaring today. Residential home values are rising, and that’s a big win for homeowners. In 2020, there was a double-digit increase in home values – a trend that’s expected to head toward similar levels this year.

However, skyrocketing prices are causing some to start questioning affordability in the current housing market. Many are quick to emphasize the fact that homes today are less affordable than they were last year. Black Knight, a leading provider of data and analytics across the homeownership life cycle, just reported on the issue.

The findings show the historical averages of the national payment to income ratio, which they define as “the share of the median income needed to make the monthly payments on the median-priced home.” Their study reveals:

The average over the last 25 years was 23.6%

The average over the last 5 years was 20.1%

The average today stands at 20.5%

Right now, housing payments are slightly less affordable than the five-year average – but only by less than ½ a percentage point. However, they’re significantly more affordable than the 25-year average. Put another way, a buyer will likely make a slightly greater financial sacrifice to afford a home right now than if they purchased a home within the last five years. On the other hand, it also means the potential financial sacrifice is not nearly as great as it was over the last 25 years.

Does making a sacrifice to buy a home today make financial sense in the long term?

Last week, the Federal Reserve announced that, in the first three months of the year, household net worth increased by $968 billion based solely on the values of the real estate they owned. Another report from CoreLogic reveals the average annual gain in homeowner equity was $33,400 per borrower.

Homeownership continues to be the cornerstone to building personal wealth. For most Americans, their home is the largest asset they own. On top of that, the difference between the net worth of homeowners and renters is significant at every income level. Here’s a table detailing that point using data from a study done by First American:

Owning a home is an essential steppingstone to grow a household’s net worth. Despite the slightly greater sacrifice in the percentage of monthly income, you’ll spend on housing today, for most homebuyers, the payoff of starting to build equity now will be worth it.

Bottom Line

Since prices have risen dramatically over the past 18 months, it’s slightly less affordable to buy a home today than it was a year ago. However, when you consider the equity gain and weigh the long-term benefits of building your net worth, you may question if you can afford not to buy now.

Source: https://bit.ly/37D9ACe

The Right Expert Will Guide You Through This Unprecedented Market

In a normal market, it’s good to have an experienced guide coaching you through the process of buying or selling a home. That person can advise you on important things like pricing your home correctly or the first steps to take when you’re ready to buy. However, the market we’re in today is far from normal. As a result, an expert isn’t just good to have by your side – an expert is essential.

Today’s housing market is full of extremes. Mortgage rates hovering near record-lows are driving high buyer demand. On the other hand, an absence of sellers is creating record-low housing inventory. This imbalance in supply and demand is leading to a skyrocketing rate of bidding wars and more houses selling over their asking price. This is driving home price appreciation and gains in home equity. These market conditions aren’t just extreme – they can be overwhelming. Having a trusted expert to coach you through the process of buying and selling a home gives you clarity, confidence, and success through each step.

In a normal market, it’s good to have an experienced guide coaching you through the process of buying or selling a home. That person can advise you on important things like pricing your home correctly or the first steps to take when you’re ready to buy. However, the market we’re in today is far from normal. As a result, an expert isn’t just good to have by your side – an expert is essential.

Today’s housing market is full of extremes. Mortgage rates hovering near record-lows are driving high buyer demand. On the other hand, an absence of sellers is creating record-low housing inventory. This imbalance in supply and demand is leading to a skyrocketing rate of bidding wars and more houses selling over their asking price. This is driving home price appreciation and gains in home equity. These market conditions aren’t just extreme – they can be overwhelming. Having a trusted expert to coach you through the process of buying and selling a home gives you clarity, confidence, and success through each step.

Here are just a few of the ways a real estate expert is invaluable:

Contracts – We help with the disclosures and contracts necessary in today’s heavily regulated environment.

Experience – We’re well-versed in real estate and experienced with the entire sales process, including how it’s changed over the past year.

Negotiations – We act as a buffer in negotiations with all parties throughout the entire transaction while advocating for your best interests.

Education – We simply and effectively explain today’s market conditions and decipher what they mean for your individual goals.

Pricing – We help you understand today’s real estate values when setting the price of your home or making an offer to purchase one.

A real estate agent can be your essential guide through this unprecedented market, but truth be told, not all agents are created equal. A true expert can carefully walk you through the whole real estate process, look out for your unique needs, and advise you on the best ways to achieve success. Finding the right agent should be your top priority when you’re ready to buy or sell a home.

So, how do you choose the right expert?

It starts with trust. You’ll have to be able to trust the advice your agent is going to give you, so make sure you’re connected to a true professional. An agent can’t give you perfect advice because it’s impossible to know exactly what’s going to happen at every turn – especially in this unique market. A true professional expert can, however, give you the best possible advice based on the information and situation at hand, helping you make the necessary adjustments and best decisions along the way. The right agent – the professional – will help you plan the steps to take for success, advocate for you throughout the process, and coach you on the essential knowledge you need to make confident decisions toward your goals. That’s exactly what you want and deserve.

Bottom Line

It’s crucial right now to work with a real estate expert who understands how the market is changing and what that means for home buyers and sellers. If you’re planning to make a move this year, let’s connect so you have someone who can answer your questions, give you the best advice, and guide you along the way.

Source https://bit.ly/37tggCV

Ready to Refinish Your Cabinets? You Have Options!

It’s been a long year, and it’s ok if you’re tired of staring at those kitchen cabinets you’ve frankly hated for years. 2021 is a year about promise and change, and you can start the process in your very own home. There are lots of ways to give your cabinets a new look, whether you prefer something more classic or super contemporary. There’s an option for every budget, and most of the time you won’t even need to replace your cabinets or counters unless you just really want to.

It’s been a long year, and it’s ok if you’re tired of staring at those kitchen cabinets you’ve frankly hated for years. 2021 is a year about promise and change, and you can start the process in your very own home. There are lots of ways to give your cabinets a new look, whether you prefer something more classic or super contemporary. There’s an option for every budget, and most of the time you won’t even need to replace your cabinets or counters unless you just really want to.

Remake Those Cabinets to Create Your Dream Kitchen

When it comes to giving your cabinets new life, you have options. Some are pretty simple and don’t require a lot of effort; some are quite challenging and may generate a great deal of mess and confusion. They’re all valid options, though, depending on just how much time you’re willing to put into the project.

You’ll have the most flexibility if you’re working with wooden cabinets, whether or not they’ve been painted previously. Laminated cabinets (also sometimes called MDF) are a bit of a different beast, and are very difficult to change once they’ve been installed. Here are a few things you should consider, depending on your cabinets:

Swapping Hardware. Sometimes, the thing making your cabinets feel old and dated is the hardware. It might sound like a small thing, but heavy cabinet hardware from the 1970s has a whole different feel than more streamlined contemporary hardware. If you’re on a small budget, or you can’t have your kitchen torn apart for an extended period, investing in new hardware could give you a whole new look.

Repainting. This is generally only a trick to try on cabinets that are made of wood, but if you use specially designed paints and primers, you can often make paint stick to laminated or metal cabinets. Choose a paint that’s self-leveling and dries hard, like a latex-based enamel cabinet paint, along with a bonding primer, for the very best results.

You’ll need to take the doors down, sand the existing finish just enough to rough it up, and allow for plenty of dry time, but because these paints are tintable, the sky is really the limit. It goes on just like other high grade paint, so mix and match colors, paint two-tone designs on your existing cabinetry, or freehand it with fancy designs for a look you really love.

Restaining. This will only work with wood cabinets, but you can really change the look of a room simply by restaining your existing cabinets. It’s possible to strip old paint off of painted cabinets, but be warned: it will be a lot of work and mess, so do it outside as much as you can.

Once you have all the old stain or paint sanded off, apply your new stain per package directions. Today’s stains come in a lot more than traditional “wood” colors; many can create simulated whitewash or aged wood, or add a thin tint of color that will still allow the wood grain to show through.

If redoing your cabinet doors seems like it may be more mess than you’re prepared to deal with, or you want to change the actual design of your cabinet doors, another viable option would be to order all new cabinet doors. You may still need to paint or stain the cabinet bases to match, but a whole new design is a lot easier to achieve with new doors, and replacing those doors is a lot simpler than replacing all your cabinets.

Need a Little Help Deciding?

Not quite sure what you want to do with your cabinets? It’s ok, we’ve all been there. Just look in HomeKeepr for a recommendation for a cabinet maker, interior designer, or general contractor with kitchen experience. These experts know how to make your dreams come to life, no matter how specific they might be.

Source www.207oceanfront.com/2021/01/26/ready-to-refinish-your-cabinets-you-have-options

10 Ways To Make Your Home Energy-efficient

Not too long ago in our country's history, talking about making your house "greener" might get you labeled a hippie tree-hugger. But times change, and as gas, electricity, and water prices creep up, more and more homeowners are seeing the (strong) advantages that come with considering the environment when you make decisions about your household.

Are you interested in making your home more energy-efficient -- and saving money in the bargain? You have a lot of options, from cheap to expensive, so read on to discover whether there are some big (or small) energy-saving opportunities that you're missing.

1. Get an energy audit

Most utility companies offer an energy audit, oftentimes for free:

They'll send an expert out to your house to take a look at all your appliances, your lights, your windows, your doors, and more -- then make recommendations for changes you can make that will save energy (and money) every month.

If you want a personalized rundown of everything you could do to and for your house to make it more energy-efficient and environmentally friendly, an energy audit is a must.

2. Swap out your lightbulbs

Compact fluorescent or even LED bulbs are more expensive than incandescent bulbs, but they also last at least 10 times longer than incandescents and use only about 25% of the energy of an incandescent bulb.

As your incandescent light bulbs flicker out, consider replacing them with a greener alternative. And if you decide to swap them all out at once, you'll start seeing a difference pretty quickly in your utility bills!

3. Pay attention to the sun

There's a lot you can do to heat and cool your home without spending any money at all -- but you'll need to keep tabs on where the sun is in the sky.

In the northern hemisphere, windows with southern exposure are going to get the most direct sunlight, so start with those.

Make note of whether and when the sun shines into your home across every season, then adjust your habits (and your blinds) accordingly.

For example, if the sun is shining directly into your house during the winter season, then you might be able to save some money on your heating bill by opening up all your curtains and blinds in the morning to allow the sun in. But if you're getting that direct sunlight in the dead heat of summer, then the opposite applies: Close your blinds and curtains in the morning to keep your house cool.

4. Weather-stripping your windows

Especially in some older houses, sometimes windows might not be entirely airtight -- meaning that you've got drafts from the outside sneaking hot or cold air into your home against your wishes.

A relatively cheap and easy fix is weatherstripping your windows to eliminate those drafts and ensure that what's outside doesn't creep inside and vice versa. It's as simple as a trip to a hardware store and a few minutes to weatherstrip each window back at the house.

5. Turn down your water heater

Hot water feels amazing in the shower ... but here's the thing: Your water heater is constantly working to keep its water consistently hot, and if you've got the gauge set at a high temperature, then "consistently hot" takes a lot of energy to maintain.

Take a look at your water heater's settings and ask yourself if the hot water really needs to be as hot as you have it.

Turning down the temperature ten or even five degrees can result in some surprising savings -- and you might not even notice when you're mixing that hot water with cold for your ablutions!

6. Collect rainwater

Depending on where you live, the weather might be an asset that you haven't tapped yet. You can't use rainwater for everything, or even very many things -- you can't drink it, and you won't want to use it to cook, wash dishes, or bathe with -- but if you keep a cistern of rainwater in your yard, then you'll always have a green way to water your grass and flowers in the spring and summer.

7. Swap out your showerheads

If you like to take long showers, this fix can be especially helpful: Change your current shower head for a low-flow version that uses less water. These often have several settings for pressure and spray so that you can customize your shower experience -- and you probably won't even notice that you're using significantly less water once you make the change.

8. Buy a smarter thermostat

You don't necessarily need a "smart" thermostat for your home (although it's always nice to change the temperature using a phone app from the couch -- just saying!), but if you don't have a thermostat that you can adjust to change the temperature at different times of the day, then you should definitely invest in one.

For example, you could set your thermostat to lower the temperature of the house by 10 to 15 degrees when you're at work during the day, and instruct it to start bringing the temperature back up to "normal" an hour to 30 minutes before you arrive home. Many thermostats even let you designate temperature by days of the week, so if you know that you're almost never home on Saturday night or Sunday morning, you can adjust your temperature accordingly.

9. Air-seal (and maybe insulate) your attic and basement

You may know that heat rises, and that applies as much inside your house as it does in the world outside.

That means a drafty attic could result in a lot of energy spent keeping the house warm in the wintertime, and it won't do you any favors in the summer, either. An uninsulated basement can also let in cold air in the wintertime and out in the summertime. Check to see if your basement and attic are air-sealed and insulated. If not, consider investing in an upgrade.

10. Use a manual push mower

If you live in a region where grass grows like weeds and you don't need to water, then maybe it makes perfect sense to keep your lawn ... but you'll still need to mow it regularly. One greener alternative to a riding mower or a motorized push version is an old-fashioned manual push mower. They do work, but you'll be using your own elbow grease instead of gasoline to power the blades, so you'll get a workout while you mow.

Deciding to make your home more energy-efficient can involve a simple move like turning off water to rarely used sinks and toilets, or as complicated and involved as replacing appliances and installing solar panels. Figure out your ideal level of investment and take things one step at a time -- before you know it, you'll have a green home that saves money without sacrificing comfort.

Home Sales Hit a Record-Setting Rebound

With a worldwide health crisis that drove a pause in the economy this year, the housing market was greatly impacted. Many have been eagerly awaiting some bright signs of a recovery. Based on the latest Existing Home Sales Report from the National Association of Realtors (NAR), June hit a much-anticipated record-setting rebound to ignite that spark.

According to NAR, home sales jumped 20.7% from May to a seasonally-adjusted annual rate of 4.72 million in June:

“Existing-home sales rebounded at a record pace in June, showing strong signs of a market turnaround after three straight months of sales declines caused by the ongoing pandemic…Each of the four major regions achieved month-over-month growth.”

This significant rebound is a major boost for the housing market and the U.S. economy. According to Lawrence Yun, Chief Economist for NAR, the momentum has the potential to continue on, too:

“The sales recovery is strong, as buyers were eager to purchase homes and properties that they had been eyeing during the shutdown…This revitalization looks to be sustainable for many months ahead as long as mortgage rates remain low and job gains continue.”

With mortgage rates hitting an all-time low, dropping below 3% for the first time last week, potential homebuyers are poised to continue taking advantage of this historic opportunity to buy. This fierce competition among buyers is contributing to home price increases as well, as more buyers are finding themselves in bidding wars in this environment. The report also notes:

“The median existing-home price for all housing types in June was $295,300, up 3.5% from June 2019 ($285,400), as prices rose in every region. June’s national price increase marks 100 straight months of year-over-year gains.”

The graph below shows home price increases by region, powered by low interest rates, pent-up demand, and a decline in inventory on the market:

Yun also indicates:

“Home prices rose during the lockdown and could rise even further due to heavy buyer competition and a significant shortage of supply.”

Bottom Line

Buyers returning to the market is a great sign for the economy, as housing is still leading the way toward a recovery. If you’re ready to buy a home this year, let’s connect to make sure you have the best possible guide with you each step of the way.

A Remarkable Recovery for the Housing Market

For months now the vast majority of Americans have been asking the same question: When will the economy turn around? Many experts have been saying the housing market will lead the way to a recovery, and today we’re seeing signs of that coming to light.

A Remarkable Recovery for the Housing Market

For months now the vast majority of Americans have been asking the same question: When will the economy turn around? Many experts have been saying the housing market will lead the way to a recovery, and today we’re seeing signs of that coming to light. With record-low mortgage rates driving high demand from potential buyers, homes are being purchased at an accelerating pace, and it’s keeping the housing market and the economy moving.

Here’s a look at what a few of the experts have to say about today’s astonishing recovery. In more than one instance, it’s being noted as truly remarkable.

Ali Wolf, Chief Economist, Meyers Research

"The housing recovery has been nothing short of remarkable...The expectation was that housing would be crushed. It was—for about two months—and then it came roaring back.”

“Recent home purchase measures have continued to show remarkable strength, leading us to revise upward our home sales forecast, particularly over the third quarter. Similarly, we bumped up our expectations for home price growth and purchase mortgage originations.”

Javier Vivas, Director of Economic Research for realtor.com

"All-time low mortgage rates and easing job losses have boosted buyer confidence back to pre-pandemic levels."

James Knightley, Chief International Economist, ING

"At face value this is remarkable given the scale of joblessness in the economy and the ongoing uncertainty relating to the path of Covid-19…The outlook for housing transactions, construction activity and employment in the sector is looking much better than what looked possible just a couple of months ago."

Bottom Line

The strength of the housing market is a bright spark in the economy and leading the way to what is truly being called a remarkable recovery throughout this country. If you’re thinking of buying or selling a home, maybe this is your year to make a move after all.

What Are Experts Saying about Home Prices?

Last week, a very well-respected real estate analytics firm surprised many with their home price projection for the next twelve months. CoreLogic, in their latest Home Price Index said: “The economic downturn that started in March 2020 is predicted to cause a 6.6% drop in the HPI by May 2021, which would be the first decrease in annual home prices in over 9 years.”

What Are Experts Saying about Home Prices?

Last week, a very well-respected real estate analytics firm surprised many with their home price projection for the next twelve months. CoreLogic, in their latest Home Price Index said:

“The economic downturn that started in March 2020 is predicted to cause a 6.6% drop in the HPI by May 2021, which would be the first decrease in annual home prices in over 9 years.”

The forecast was surprising as it was strikingly different than any other projection by major analysts. Six of the other eight forecasts call for appreciation, and the two who project depreciation indicate it will be one percent or less.

Here is a graph showing all of the projections:

There’s a simple formula to determine the future price of any item: calculate the supply of that item in ratio to the demand for that item. In housing right now, demand far exceeds supply. Last week mortgage applications to buy a home were 33% higher than they were at the same time last year. The available inventory of homes for sale is 31% lower than it was last year. Normally, these numbers should call for homes to continue to appreciate.

Bottom Line

Because of the uncertainty with the pandemic, any economic prediction is extremely difficult. However, looking at the limited supply of homes for sale and the tremendous demand for housing, it is difficult to disagree with the majority of analysts who are calling for price appreciation.

Taking Advantage of Homebuying Affordability in Today’s Market

Everyone is ready to buy a home at different times in their lives, and despite the health crisis, today is no exception. Understanding how affordability works and the main market factors that impact it may help those who are ready to buy a home narrow down their optimal window of time to make a purchase.

Taking Advantage of Homebuying Affordability in Today’s Market

Everyone is ready to buy a home at different times in their lives, and despite the health crisis, today is no exception. Understanding how affordability works and the main market factors that impact it may help those who are ready to buy a home narrow down their optimal window of time to make a purchase.

There are three main factors that go into determining how affordable homes are for buyers:

Mortgage Rates

Mortgage Payments as a Percentage of Income

Home Prices

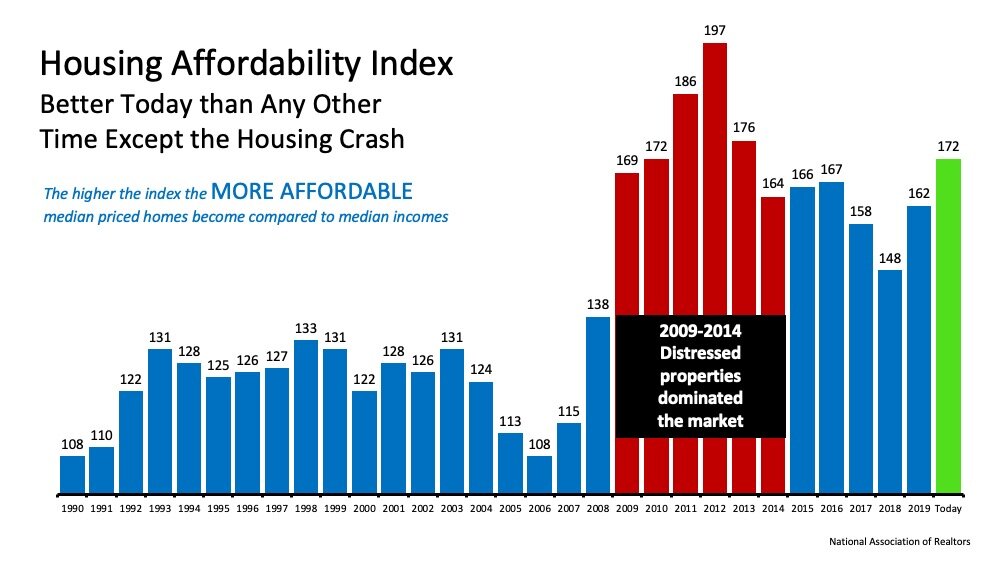

The National Association of Realtors (NAR), produces a Housing Affordability Index, which takes these three factors into account and determines an overall affordability score for housing. According to NAR, the index:

“…measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent price and income data.”

Their methodology states:

“To interpret the indices, a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20 percent down payment.”

So, the higher the index, the more affordable it is to purchase a home. Here’s a graph of the index going back to 1990:

The green bar represents today’s affordability. We can see that homes are more affordable now than they have been at any point since the housing crash when distressed properties (foreclosures and short sales) dominated the market. Those properties were sold at large discounts not seen before in the housing market.

Why are homes so affordable today?

Although there are three factors that drive the overall equation, the one that’s playing the largest part in today’s homebuying affordability is historically low mortgage rates. Based on this primary factor, we can see that it is more affordable to buy a home today than at any time in the last seven years.

If you’re considering purchasing your first home or moving up to the one you’ve always hoped for, it’s important to understand how affordability plays into the overall cost of your home. With that in mind, buying while mortgage rates are as low as they are now may save you quite a bit of money over the life of your home loan.

Bottom Line

If you feel ready to buy, purchasing a home this season may save you significantly over time based on historic affordability trends. Let’s connect today to determine if now is the right time for you to make your move.

Want to Make a Move? Homeowner Equity is Growing Year-Over-Year

One of the bright spots of the 2020 real estate market is the growth in equity homeowners are experiencing across the country. According to the recently released Homeowner Equity Insights Report from CoreLogic, in nearly every state there was a year-over-year first-quarter equity increase, averaging out to a 6.5% overall gain.

Want to Make a Move? Homeowner Equity is Growing Year-Over-Year

One of the bright spots of the 2020 real estate market is the growth in equity homeowners are experiencing across the country. According to the recently released Homeowner Equity Insights Report from CoreLogic, in nearly every state there was a year-over-year first-quarter equity increase, averaging out to a 6.5% overall gain.

The report notes:

“CoreLogic analysis shows U.S. homeowners with mortgages (roughly 63% of all properties) have seen their equity increase by a total of nearly $590 billion since the first quarter of 2019, an increase of 6.5%, year over year.” (See map below):

This means that “In the first quarter of 2020, the average homeowner gained approximately $9,600 in equity during the past year.”

That’s a huge win for homeowners, especially for those looking to sell their houses and make a move this summer. Having equity to re-invest in your next home is a major force that can make moving a reality, especially while buyers are expressing such a high demand for homes to purchase.

Frank Martell, President and CEO of CoreLogic addresses the potential long-term outlook and how homeowners will likely fare much more positively through the current recession than many did during the last one:

"Many homeowners will experience a recession during their lifetime, and it is reasonable to compare the current recession to those in the past. But the comparison is not apples to apples — every recession is different. Primary drivers of the Great Recession were an overbuilt housing stock, risky mortgages and the collapse of home prices, creating a massive increase in negative equity that proved difficult to recover from. Today’s housing environment has low vacancy and delinquency rates and a large home equity cushion.”

Bottom Line

Now is a great time to consider leveraging your equity and making a move, especially while buyer interest is high. Let’s connect to explore your equity position and make your next move a reality.

Homebuyers Are in the Mood to Buy Today

According to the latest FreddieMac Quarterly Forecast, mortgage interest rates have fallen to historically low levels this spring and they’re projected to remain low. This means there’s a huge incentive for buyers who are ready to purchase. And homeowners looking for eager buyers can take advantage of this opportune time to sell as well.

Homebuyers Are in the Mood to Buy Today

According to the latest FreddieMac Quarterly Forecast, mortgage interest rates have fallen to historically low levels this spring and they’re projected to remain low. This means there’s a huge incentive for buyers who are ready to purchase. And homeowners looking for eager buyers can take advantage of this opportune time to sell as well.

There’s a very positive outlook on interest rates going forward, as the projections from the FreddieMac report indicate continued lows into 2021:

“Going forward, we forecast the 30-year fixed-rate mortgage to remain low, falling to a yearly average of 3.4% in 2020 and 3.2% in 2021.”

With mortgage rates hovering at such compelling places, ongoing buyer interest is bound to keep driving the housing market forward. Rates also reached another record low last week, so homebuyers are in what FreddieMac is identifying as the buying mood:

“While the rebound in the economy is uneven, one segment that is exhibiting strength is the housing market. Purchase demand activity is up over twenty percent from a year ago, the highest since January 2009. Mortgage rates have hit another record low due to declining inflationary pressures, putting many homebuyers in the buying mood. However, it will be difficult to sustain the momentum in demand as unsold inventory was at near record lows coming into the pandemic and it has only dropped since then.”

There’s no doubt that even though buyers are ready to purchase, it’s hard for many of them to find a home to buy today. Mortgage rates aren’t the only thing hovering near all-time lows; homes available for sale are too. With housing inventory as scarce as it is today – a nearly 20% year-over-year decline in available homes to purchase – keeping buyers in the purchasing mood may be tough if they can’t find a home to buy (See graph below):

What does this mean for buyers?

Competition is hot with so few homes available for purchase and low mortgage rates are helping to drive affordability as well. Getting pre-approved now will help you gain a competitive advantage and accelerate the homebuying process, so you’re ready to go when you find that perfect home you’d like to buy. Working quickly and efficiently with a trusted real estate professional will help put you in a position to act fast when you’re ready to make your move.

What does this mean for sellers?

If you’re thinking of selling your house, know that the motivation for buyers to purchase right now is as high as ever with rates where they are today. Selling now before other sellers come to market in your neighborhood this summer might put your house high on the list for many buyers. Homebuyers are clearly in the mood to buy, and with today’s safety guidelines and precautions in place to show your house, confidence is also on your side.

Bottom Line

Whether you’re looking to buy or sell, there’s great motivation to be in the housing market, especially with mortgage rates hovering at this historic all-time low. Let’s connect today to make sure you’re ready to make your move.